Make talent quality your leading analytic with skills-based hiring solution.

We all know that developing a brilliant banking talent requires time-tested candidate assessments. Especially today, when banks, as well as their employees, have to keep up with all the new technologies being used in this niche.

On the other hand, HRs can significantly shorten this process by hiring the right people from the very start. But how can you find technologically proficient personnel, the so-called tech talent, and ensure a consistent customer experience across multiple platforms and devices? This is exactly where candidate assessments for the banking sector fit in.

Hiring for the banking sector in a highly competitive environment needs tremendous research. Let’s explore the new challenges in the recruitment process and see how talent assessment software can help the finance sector, HR, and talent acquisition staff develop brilliant teams and achieve marvelous results.

At this point, it’s safe to assume that the banking industry outlook for 2022 will go beyond digital. Numerous technologies, some more than others, have been reshaping the future of the banking landscape including hiring for a while now.

The final result is virtual candidate assessments, automated processes, cutting down operation costs, the ability to quickly launch new services and products to adjust to volatile and changing markets and highly personalized customer service. All of these things created new jobs in the finance sector, a nightmare for recruitment experts, and confusion in the banking job search process.

Apart from the top 5 skills to become a banker, specific technology trends have opened doors for banking jobs. It’s no surprise if candidate assessments are framed in these areas:

In 2030, I would say that you probably have two billion people that’ll be using day-to-day banking services, independent of banking.

Brett King, Co-founder, and CEO, Moven

AI is already being put to use by some of the world’s biggest banks apart from candidate assessments.

AI has become attractive for the banking sector because it’s capable of streamlining, automating, and improving the hiring process by:

As customers become increasingly tech-savvy, banks have to respond by digitizing their services, and this cannot be done without the technical staff on board. Powered by AI, candidate assessment software brings all the benefits mentioned above and then some.

Banks are already using this solution to make the most of assessments for hiring, cut through the noise of underqualified employees, and battle tech talent shortage.

Candidate assessments software features several different tests for different types of banking jobs. It allows the recruiters to identify the best candidates, the ones who will be able to grow together into a brilliant team.

These tests are:

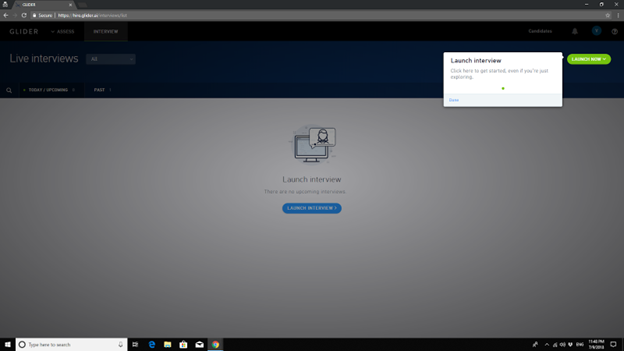

When it comes to sourcing talent, candidate assessments software, Glider was built to help you find the perfect match. Since the future of banking is closely tied to the use of AI, Glider was built on it so that it can help banks streamline and automate the recruitment process. It allows you to match the best job candidates to a specific spot in every team, including IT.

Glider AI’s candidate assessments feature an intuitive UI and is easy to use. In fact, you will be able to use it to its full capacity even with a limited technical background. With built-in contextual help, you will be able to master it in no time.

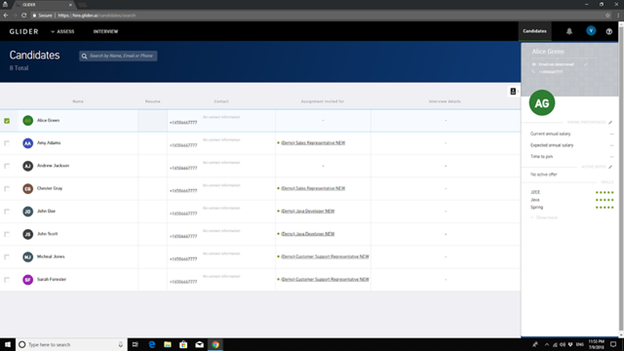

In the candidate’s tab, you can quickly browse through your job candidates, review candidate assessment scores, and proficiency, and invite them to interviews.

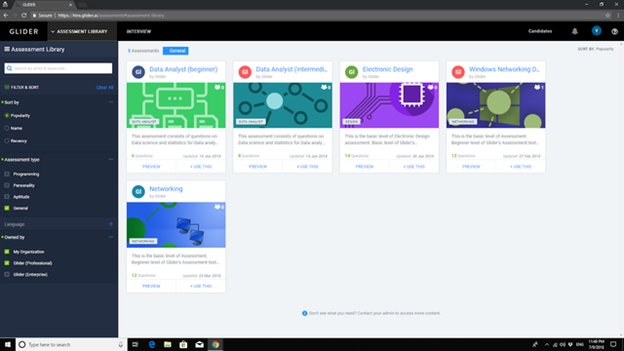

Glider AI integrates dozens of pre-built assessment softwares to help you speed up your hiring process and base your decisions on accurate data. Take a look.

Careers in banking sector are going to grow only bigger and better. Candidate assessments software powered by AI will help you identify the best job candidates, make your recruitment process efficient, build brilliant teams, and ultimately bring a stronger organization.

The Glider assessment suite gives hiring teams a structured and reliable way to evaluate skills across technical, functional, behavioral, and coding domains. With a focus on accuracy and fairness, Glider AI helps recruiters identify talent with confidence while creating a clear and supportive experience for candidates. This guide outlines each part of the Glider assessment […]

Engineering roles stay open longer than almost any other position. You know the pattern: a req opens, applications flood in, resumes get reviewed, phone screens happen, and then the pipeline stalls. Candidates who looked strong on paper can’t solve basic problems. Others talk a good game but can’t write functional code. By the time you […]

Hiring behavioral consultants can be challenging. Organizations often rely on resumes and interviews to gauge skills, but these methods rarely reveal how a candidate will perform in real-world scenarios. Misjudging traits like problem-solving, adaptability, and interpersonal skills can lead to mis-hires, wasted training efforts, and lower team productivity. How to Conduct a Initial Behavioral Assessment […]